Summary -

In this topic, we described about the below sections -

A business unit in any company can be classified as profit center, cost center or an investment center. Cost center is a simple and straightforward division in an organization. Cost Center known as a component in an organization where costs are incurred that adds value to the cost and adds profit of the organization.

Hierarchical structure of a cost center should define to create cost center. Source related assignment is difficult for overhead costs and CCA analyses the overhead costs according to where they were occurred within the organization. CCA stands for Cost Center Accounting.

CCA used for cost controlling purpose within the organization. The costs incurred by the organization should be transparent. CCA enables us to check the individual functional areas profitability and provide decision-making data for management. We need to create company code, Chart of Accounts COA’s to implement CCA with Finance Accounting.

Cost Center Uses:

- Align overhead costs with activities performed in an organization.

- Assigning the cost-to-cost centers for products and services that are involved in performing these activities directly.

- Manage, analyse and verify the overhead cost in an organization.

- Performing cost center accounting to manage cost in the organization.

- Planning costs at cost center when costs are incurred in the organization.

- Verifying the profitability of each functional area and decision-making data.

Cost Center Features:

Activity Accounting - Uses the activity produced by a cost center as the tracing factor for the costs.

The same activity used to rate the cost center capacity utilization.

The cost center activities divided into various types based on the costs source.

Allocating actual costs - Uses to allocate the actual costs according to their source.

Allocating plan costs - Plans all actual allocations occur for cost centers.

Entering actual costs - Transfer primary costs to Cost Accounting from other components.

Information system - Provides tools to analyse the cost flows that have occurred in the organization.

Planning activities and costs - Planning to define organizational targets and perform regular cost-effectiveness checks.

Variances can be calculated by comparing the actual costs and activities with the plan values.

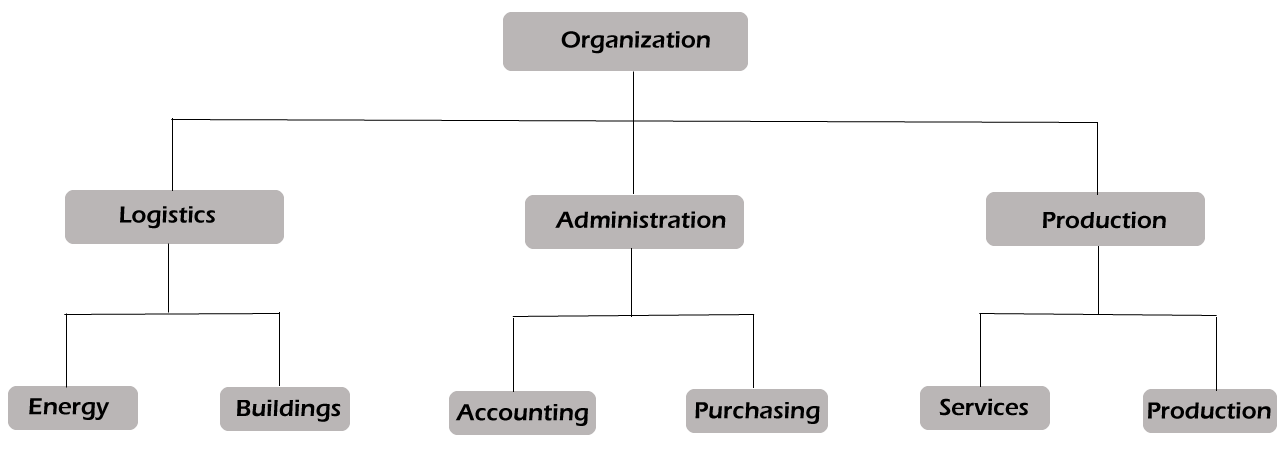

Cost Center Hierarchy:

Let us take Organization as an example to explain cost center hierarchy. From the top, the organization further divided into functional areas. Each Functional area is further divided into sub-areas and divided further according to the activities performed.

CCA tasks & Main area’s:

- Analysing costs and Assigning costs to cost centers.

- Master data in cost element and CCA.

- Organizational structures in cost element and CCA.

- Periodic allocation methods for costs in CCA.

- Planning cost centers activities, prices and costs, cost allocations in CCA.

- Structuring cost elements and cost centers.

- Tools for transaction-based postings in CCA.