Summary -

In this topic, we described about the below sections -

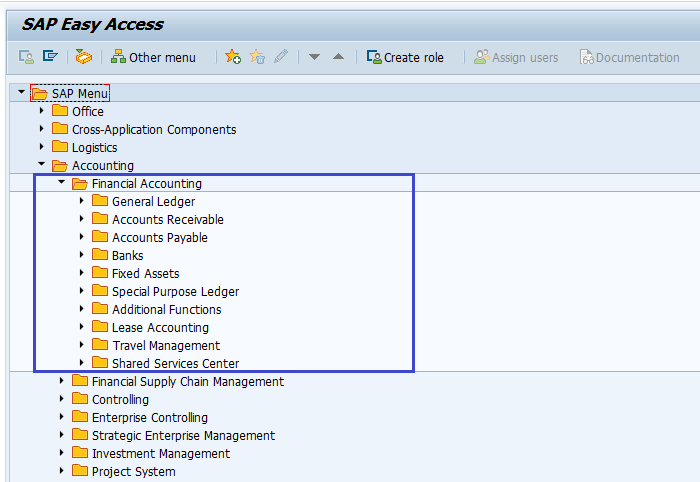

The Financial Accounting(FI) application component include below sub-components:

- Accounts Payable (FI-AP)

- Accounts Receivable (FI-AR)

- Asset Accounting (FI-AA)

- Bank Accounting (FI-BL)

- Funds Management (FI-FM)

- General Ledger (FI-GL)

- Special Purpose Ledger (FI-SL)

- Travel Management (FI-TV)

Finance Accounting – Accounts Payable (FI-AP): -

Accounts payables is a sub component and captures all transactions related to vendors. It records and administers accounting data for all vendors. It is part of the purchasing system and the system automatically makes postings in response to the operative transactions.

Accounts Payable postings are simultaneously recorded in the General Ledger. Different G/L accounts are updated in General Ledger according to the transactions involved such as payables and down payments in real time.

Accounts payable includes all vendor transactions. Accounts payable transactions include automatic payment program, credit memo posting, down payments, executing vendor reports invoice payment and invoice posting.

Some of Accounts Payable Tables −

- LFA1

- LFBK

- LFM2

Finance Accounting – Accounts Receivable (FI-AR): -

Accounts receivables is a sub component that captures all transactions with customer accounts. It records and administers accounting data of all customers. It is part of sales management.

All postings in Accounts Receivable are recorded directly in the General Ledger. Different G/L accounts in General Ledger are updated depending on the transactions involved like receivables, down payments and bills of exchange.

Transactions in accounts receivables include invoice posting, credit memo posting, down payments, invoice payment and executing customer reports.

Some of Accounts Receivable Tables −

- BSIW

- KNA1

- KNVV

Finance Accounting – Asset Accounting (FI-AA): -

Asset accounting manages all transactions related to assets. It is used for managing and supervising fixed assets with the SAP System. It serves as a subsidiary ledger to the General Ledger providing detailed information on transactions involving fixed assets.

The asset accounts in general ledger are updated with transactions involved in real time. Asset accounting transactions include asset acquisition, asset retirement, asset sale, asset transfer, asset revaluation and asset depreciation etc.

The Asset Accounting component contains below parts:

- Traditional asset accounting

- Processing leased assets

- Preparation for consolidation

- Information System

Finance Accounting – Bank Accounting (FI-BL): -

It is used to handle all accounting transactions processing with bank. Bank Accounting includes the management of bank master data and cash balance management.

Bank Accounting also responsible for creating and processing of incoming and outgoing payments. All transactions are updated in real-time without any delay and with full accuracy.

Some of Bank Accounting Tables −

- LFBK

- BNKA

- KNBK

Finance Accounting – Funds Management (FI-FM): -

It is used to manage the funds in an organization. This component interacts with other components like FI-BA, FI-GL, FI-AP, FI-AR and FI-MM etc, to collect the fund details. This component functions support in creating and executing budgets.

The Funds Management purpose is to budget all revenues and expenditures for individual/distributed in an organization. It also helps an organization to create budget forecasting and to use the funds in a proper way.

Some of Funds Management Tables −

- FMFCTR

- FMIFIIT

- FMIT

Finance Accounting – General Ledger (FI-GL): -

The G/L accounting task is to provide a comprehensive picture for external accounting and accounts. All general ledger accounts used for reporting are managed through general ledger accounting.

Most of the transactions recorded in sub components and those transactions reconciled with general ledgers in real time. Recording all business transactions in a software system that fully integrated with all the other operational areas of an organization to ensure that the accounting data is accurate and complete.

General ledger accounting transactions includes journal vouchers to adjust the transactions. Reversals can be performed from general ledger accounting.

Finance Accounting – Special Purpose Ledger (FI-SL): -

Special Purpose Ledger used to define ledgers for reporting purposes. The special purpose ledgers enable to report the values from the various application components at various levels.

The special purpose ledgers functions enable to collect and combine information, create and modify totals and distribute actual and plan values. The special purpose ledgers transfer the values from other SAP applications and external systems.

Finance Accounting – Travel Management (FI-TV): -

Travel Management supports all processes involved in handling business travel expenses. Its functionality is integrated with settlement, taxation and payment processes. Travel planning, requests and expenses involved in all the requested trips.

Travel Management enables to request, plan, and book trips, create travel expense reports and transfer expense data. It provides the best way to manage the travel expenses of an organization as it integrated with all other sub components.

Some of Travel Management Tables −

- TA22B

- PTRV_HEAD

- FTPT_PLAN

- FTPT_ITEM