Summary -

In this topic, we described about the Post Customer Foreign Currency Invoice process along with technical information.

Customer invoices can be posted in foreign currency can be used to process a currency analysis.

Post Customer Foreign Currency Invoice: -

Below process is to post customer foreign currency invoice.

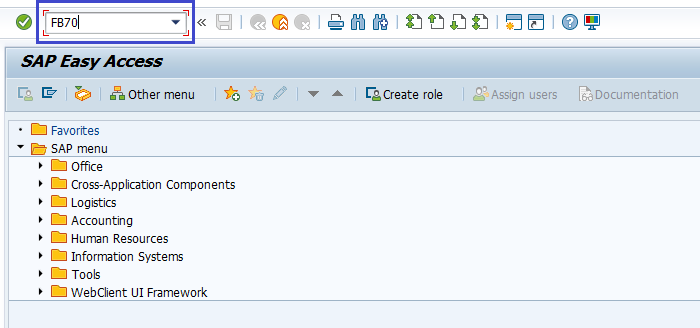

Step-1: Enter the transaction code FB70 in the SAP command field and click Enter to continue.

(OR)

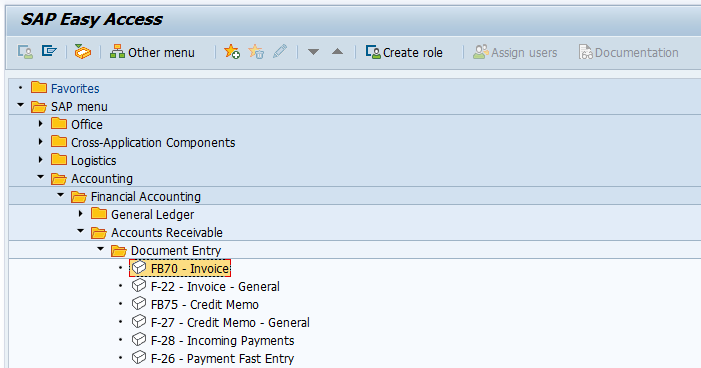

Go to SAP Menu → Accounting → Financial Accounting → Accounts Receivable → Document Entry → Invoice.

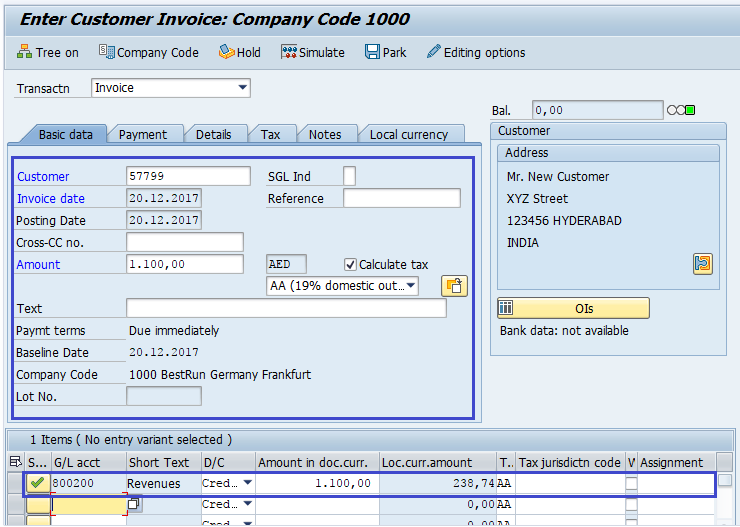

Step-2: In the next screen, enter the Company Code and click Enter.

Step-3: In the next screen, enter the below details in the Basic data tab.

- Customer Id of the customer

- Invoice Date

- Document Type as Vendor Invoice

- Invoice Amount in Currency

- Tax Code applicable in the invoice

- Purchase G/L Account to be credited

- Credit Amount

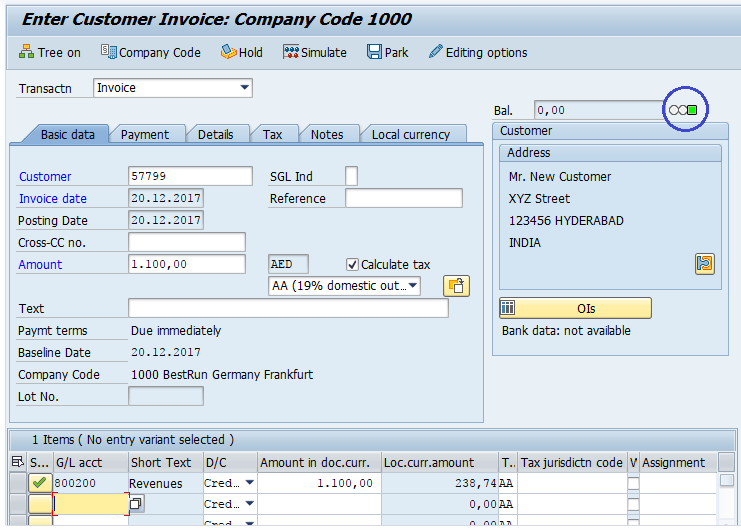

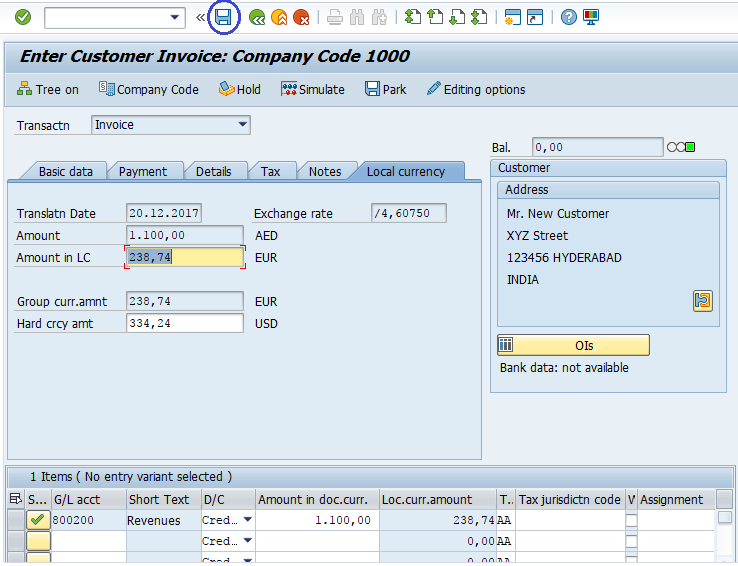

Step-4: Check the document status.

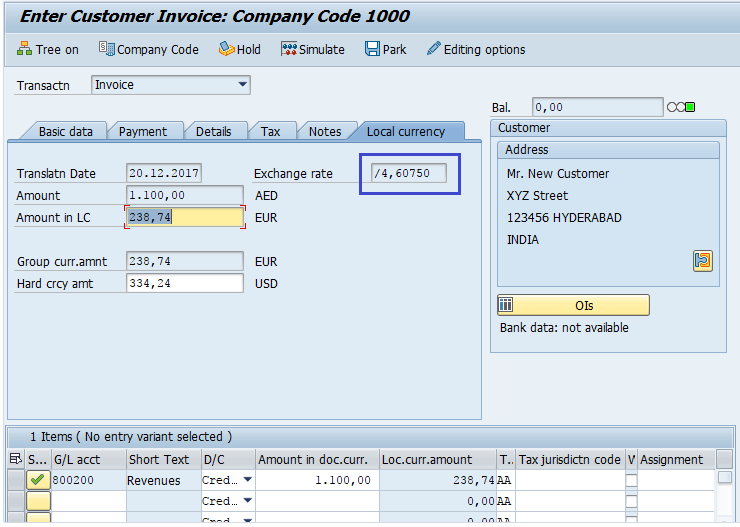

Step-5: In the Local Currency tab, Verify/adjust Exchange Rate.

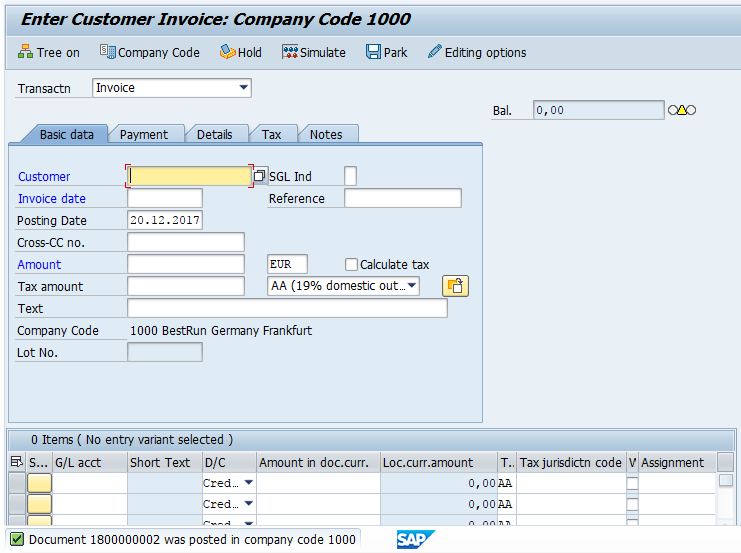

Step-6: Once all the details entered, click on the Save button to save the changes.

Step-7: Status bar displays the generated document number once the foreign currency invoice posted successfully.

Technical Information: -

- Transaction Code: - FB70

- Navigation path: - SAP Menu → Accounting → Financial Accounting → Accounts Receivable → Document Entry → FB70 -- Invoice