Summary -

In this topic, we described about the Post Vendor Foreign Currency Invoice process along with technical information.

Vendor invoices can be posted in foreign currency can be used to process a currency analysis.

Process: -

Below process shows how to post a vendor foreign currency invoice.

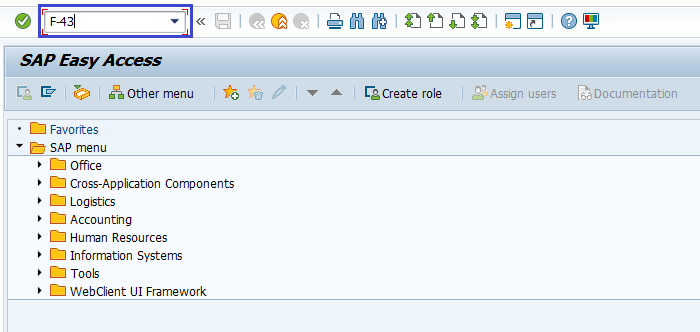

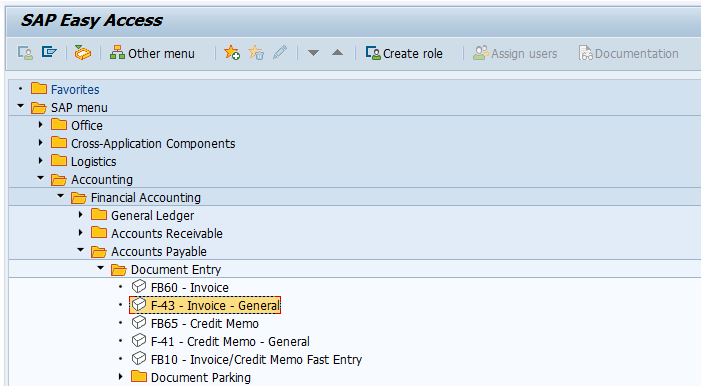

Step-1: Enter the transaction code F-43 in the SAP command field and click Enter to continue.

(OR)

Go to Sap Menu → Accounting → Financial Accounting → Accounts Payable → Document entry → F-43 - Invoice - General .

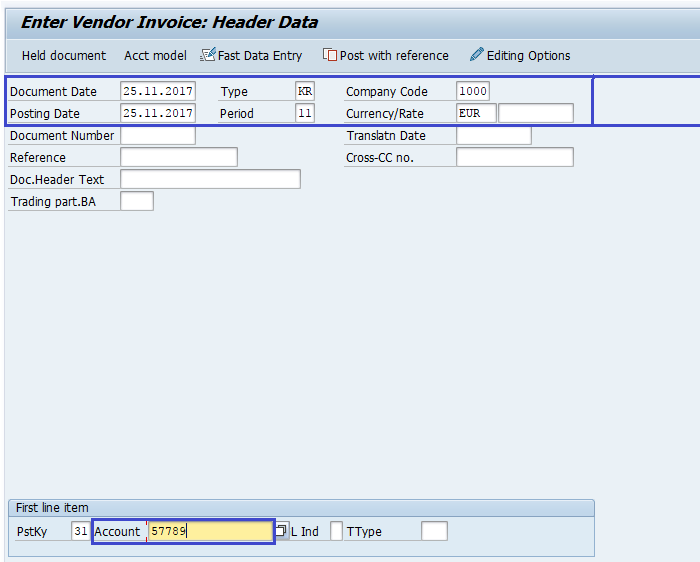

Step-2: In the next screen, enter the below details and press Enter.

- Document Date

- Document Type

- Company Code

- Posting Date

- Currency

- PstKy

- Account (Vendor)

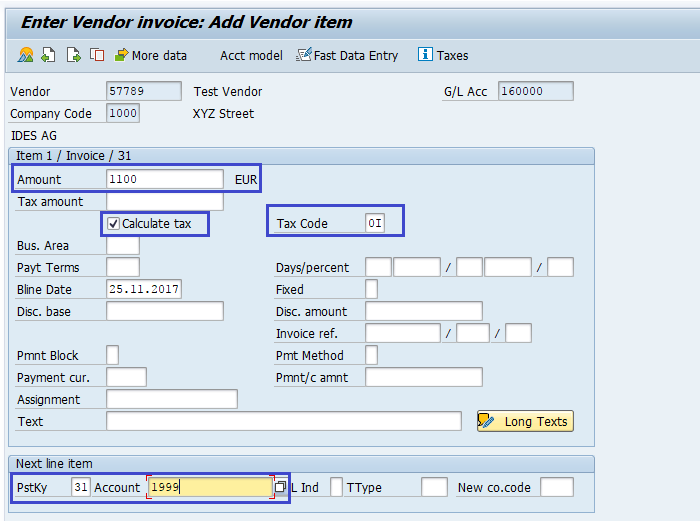

Step-3: Input the amount, calculate tax, Tax code, PstKey, Account (Revenue account) and press Enter.

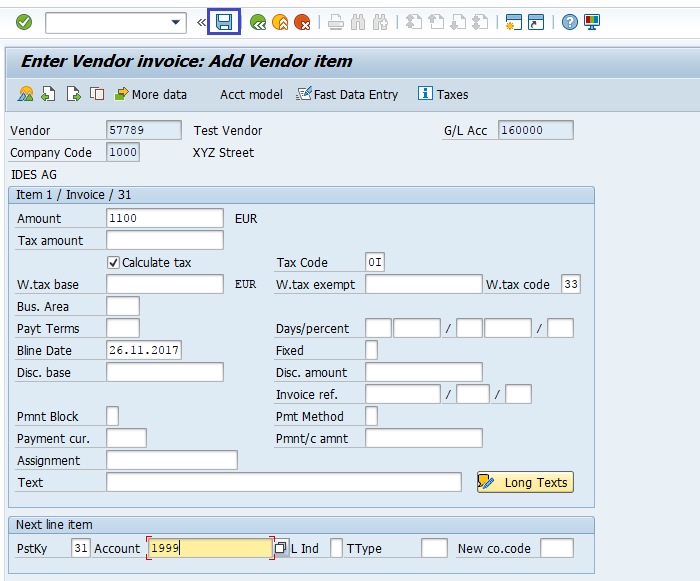

Step-4: Once all the details entered, click on the Save button to save the changes.

The Status bar displays the generated document number once the vendor foreign currency invoice posted successfully.

Technical Information: -

- Transaction Code: - F-43

- Navigation path: - Sap Menu → Accounting → Financial Accounting → Accounts Payable → Document entry → F-43 - Invoice - General