SAP CCA Product Costing

Product Costing is used to value the internal cost of materials and also used for production for management accounting and profitability. Due to costing’s high integration with other modules and complexity, the product costing is avoided.

The basics of Product Costing is Cost Center Planning. Product Costing configuration involves two areas −

- Product Cost Planning

- Cost Object Controlling

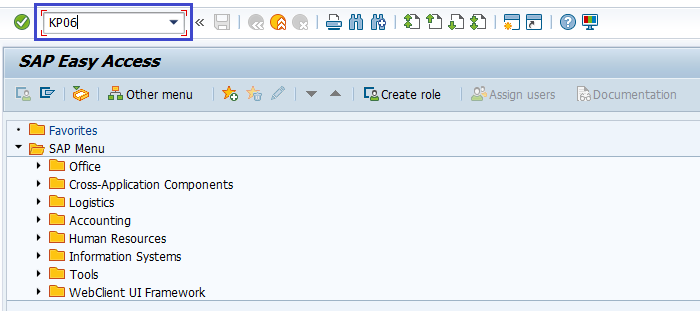

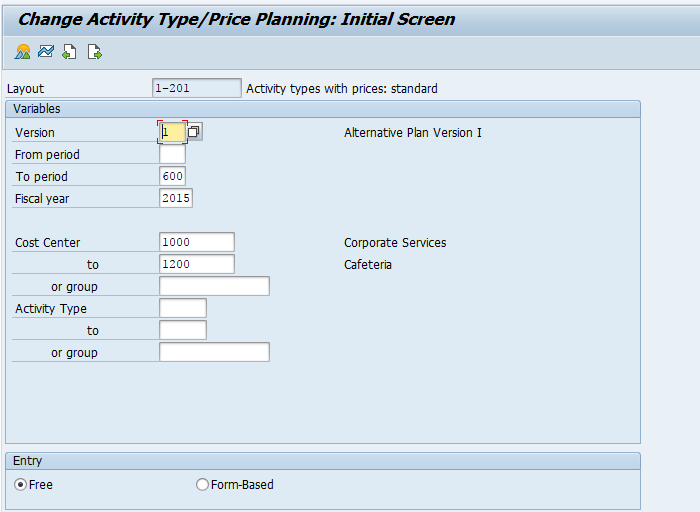

Step-1:- Go to transaction code KP06. Cost Center dollars are planned by Activity-Type and cost element.

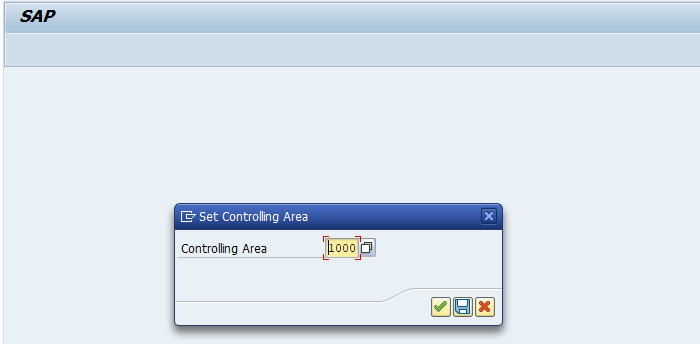

Step-2:- Enter the Controlling Area and tick mark.

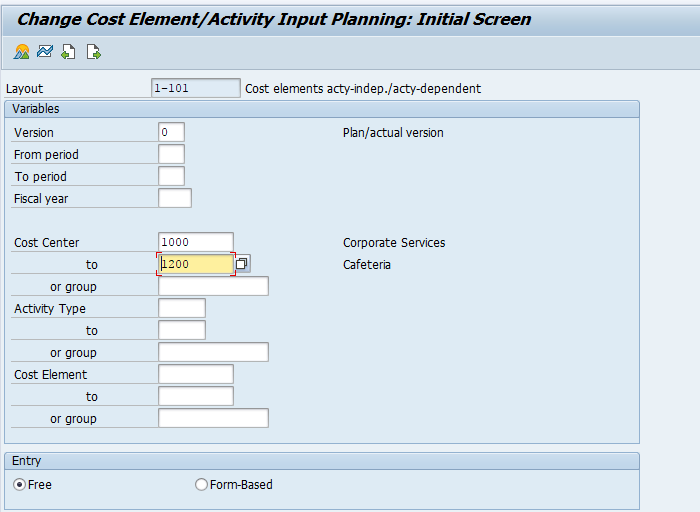

Step-3:- Cost Center dollars are planned by Activity-Type and cost element. Enter the activity type, cost element and fixed dollar amounts.

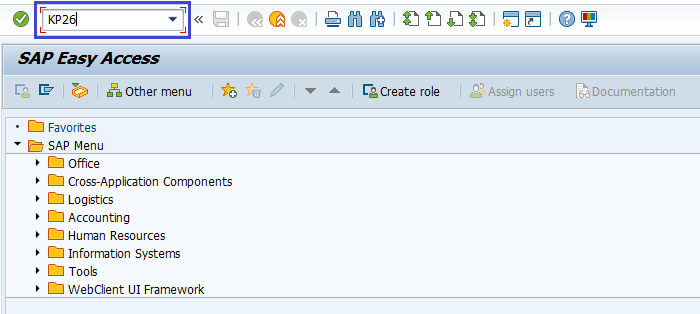

Step-1:- Go to transaction code KP26, to define cost center activity quantities.

Step-2:- Enter an activity rate based on last year's actual values.

To plan activity quantities based on practical installed capacity. If plan at full capacity, plan activity rates will be underestimated.